If you're an Australian living in the United States, the end of the Australian financial year (EOFYS ads ringing in your ears?) might not be top of mind—but it should be. While your U.S. tax obligations are important, you may still have ties to Australia that require attention as soon as possible. From investment properties to HECS debt, this time of year can have real consequences for your tax obligations and future financial plans.

Even if you don’t think you “earn income” in Australia anymore, you might be surprised to learn how many expats still need to submit something to the ATO—or risk fines and unexpected issues down the track.

Common Traps for Expats

Here are just a few of the common traps we see expats fall into:

- Forgetting to declare Australian-sourced rental income

- Not updating residency status with the ATO

- Assuming you don’t need to lodge a return just because you’re abroad

- Missing the 10% withholding on property sales

- Not realizing your HECS debt is still accruing

The result? Late fees, interest, and unwanted mail from the ATO.

Want a Simple Checklist?

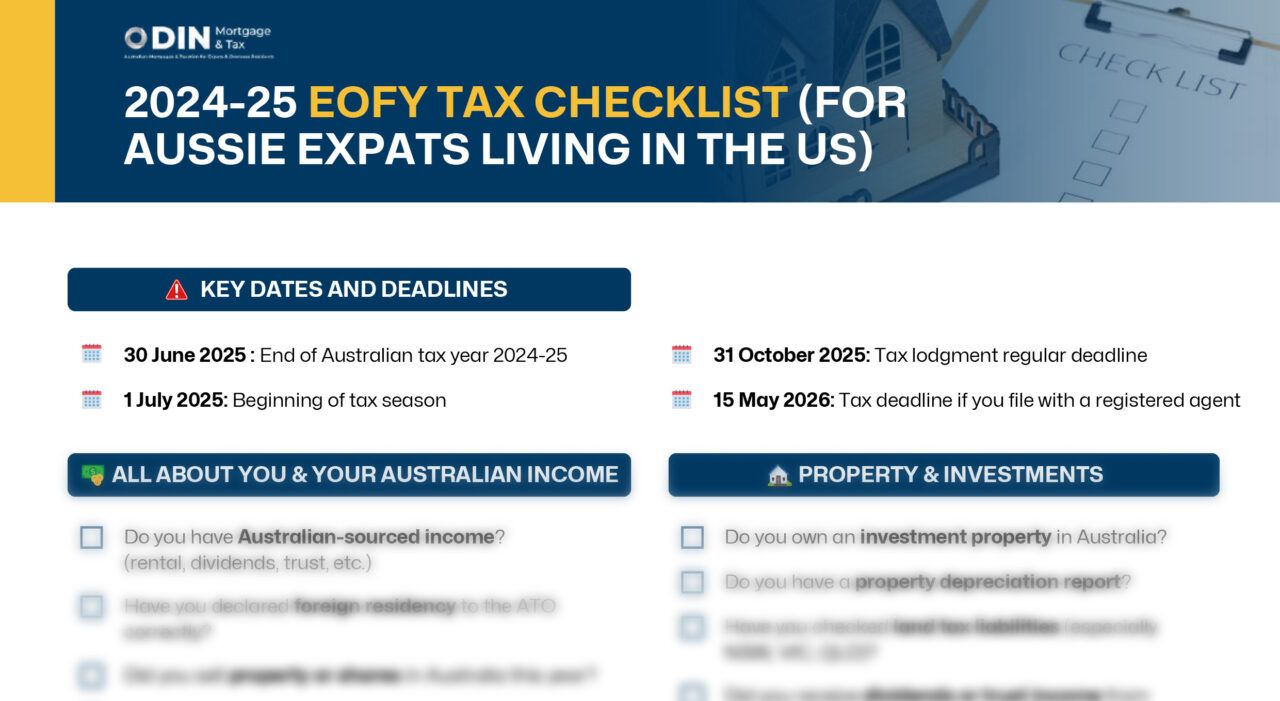

To help you get organized, we’ve teamed up with Odin Mortgage & Tax to put together an Australian Expat EOFY Checklist—a simple, no-jargon summary of what to check, what to file, and what not to forget before June 30.

It’s perfect for:

- Aussies in the U.S. with property, super, or investments

- Anyone who’s unsure if they still need to file with the ATO

- Those juggling U.S. and Australian financial years

- New arrivals in the US who might still have active tax status in Australia

Fill in the form below to get your copy of the checklist delivered straight to your inbox.

Download Australian's End of Financial Year: What You Must Not Forget as an Expat in America

Stay ahead of your obligations. Your future self will thank you.

I am truly thankful to the owner of this web site who has shared this fantastic piece of writing at at this place.