It's tax time. Boo. “Tax Day” is actually Wed, Apr 15, 2026, so if you haven't done your taxes yet in the US, you better get to it! Here's a quick summary of what you should remember. Most likely you need to file taxes in at least the US (if not multiple countries) so here's a guide.

First things first, we want to work out whether this date means anything to (and more importantly, whether it should)!

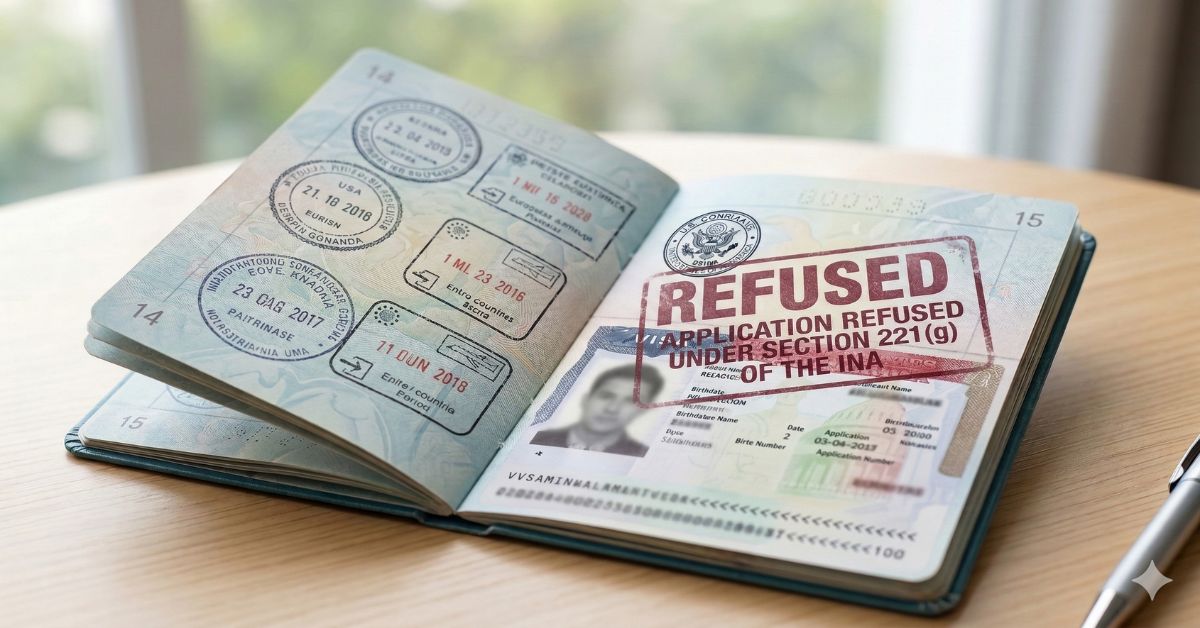

Do I need to file US tax as a non-citizen on a visa?

To be considered a “resident for tax purposes” you just need to check out the IRS's website, and look into the “Substantial Presence Test”:

You will be considered a United States resident for tax purposes if you meet the substantial presence test for the calendar year. To meet this test, you must be physically present in the United States (U.S.) on at least:

- 31 days during the current year, and

- 183 days during the 3-year period that includes the current year and the 2 years immediately before that, counting:

- All the days you were present in the current year, and

- 1/3 of the days you were present in the first year before the current year, and

- 1/6 of the days you were present in the second year before the current year.

So, with a little math(s) you can work out whether you need to be filing at all. It's not a huge threshold so most people who would consider themselves “living” in the US would definitely need to be filing.

This doesn't apply to some visas, so it's worth checking out this guide on the IRS's website which outlines taxation of “aliens” by Visa Type and Immigration status. For example:

In most cases, the days the alien is in the United States as a teacher, student, or trainee on an “F”, “J”, “M”, or “Q” visa are not counted. This exception is for a limited period of time. For more information on resident and nonresident status, the tests for residence, and the exceptions to them, refer to Publication 519, U.S. Tax Guide for Aliens.

How to file tax in the U.S.

I've actually already written about filing, so be sure to head over to my tax information for expats and I sat down with my favorite tax lawyer, Jason Stoch of UpTrend Advisory for a webinar recently talking through some of the most frequently asked questions about tax!

This includes information about recommended accountants, and the standard practices involved!

What is FBAR and do I need to file an FBAR?

As an expat, you may have heard a lot of about FBAR. If you haven't, well you should have.

Again, from the IRS's page on Report of Foreign Bank and Financial Accounts (FBAR):

If you have a financial interest in or signature authority over a foreign financial account, including a bank account, brokerage account, mutual fund, trust, or other type of foreign financial account, exceeding certain thresholds, the Bank Secrecy Act may require you to report the account yearly to the Department of Treasury by electronically filing a Financial Crimes Enforcement Network (FinCEN) 114, Report of Foreign Bank and Financial Accounts (FBAR).

Who Must File an FBAR

United States persons [(includes U.S. citizens; U.S. residents;)] are required to file an FBAR if:

- the United States person had a financial interest in or signature authority over at least one financial account located outside of the United States; and

- the aggregate value of all foreign financial accounts exceeded $10,000 at any time during the calendar year reported.

So if you have more than $10,000 combined in bank accounts overseas (at any time throughout the year), you must file an FBAR! This initiative was started as a means of stopping corruption and money laundering, so don't think you can skirt around without filing, you will be found!

You can actually do this all online, through the Financial Crimes Enforcement Network (FINCEN). It's quick, and easy, and you just need to make sure that what you report is accurate.

Do you need an accountant to file your taxes?

So, no. You don't need an accountant to file your taxes but I would urge you to speak to one if you've just moved to the US and you've never filed before. Get an accountant to go over everything, present them with all the information, and then you'll know what you need to be filing in the future.

Who do I recommend? I get my taxes done by Jason Stoch at UpTrend Advisory and can therefore highly recommend him as he's aware of international requirements more than any other accountant I've spoken to before.