The last thing on your mind when you head to your holiday parties in December is tax, I know, but as the year draws to a close, it's important to take a quick minute and prepare before year end. Getting organized early can help ensure a smoother process and possibly better tax outcomes (and most importantly avoiding any traps). To help you out, we've created a checklist for everything you should consider before you raise a glass to 2023.

Whether you're an individual taxpayer, a family member with dependents, a freelancer, or something in between, it's important to know that there are going to be a wide range of questions you're asked by your accountant or in tax preparation documents. It's also possible that there are things you should have done before year end, and we don't want you to miss the window!

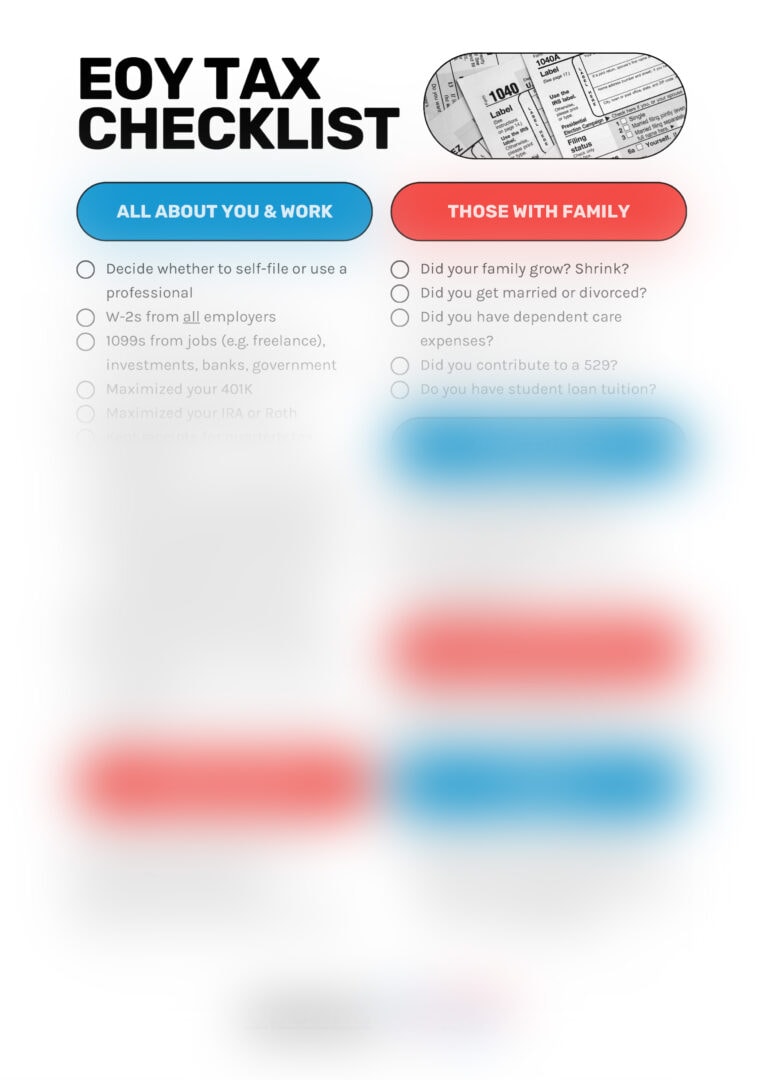

Download the 2023/24 tax checklist

Here's the ultimate checklist for what you need to sort out before the year ends.

Included in the checklist is

- Individual and work requirements;

- Considerations for family members;

- Specifics for business owners and freelancers;

- Checklists for investments and receipts; and

- Some extra tips to make things work smoothly.

Express December Webinar (with cocktails)

We know you don't want to talk tax for too long, so Jason from Uptrend Advisory (US tax experts for Australians and expats) and Josh (America Josh) sat down for a 15 minute express webinar to talk through the checklist.

Ready for more? Register now for our tax webinar in February 2024!

You're no doubt going to have lots of questions, so Jason and Josh will be sitting down for an hour long webinar answering all your submitted questions on February 6, 2024 at 8pmET USA / 5pmPT USA / 12pm EST (Feb 7, 2024) in Australia.

Register now for US Taxes for Expats: Our Tax Expert Answers Your Questions

Key topics that we'll cover (along with answering your questions):

- Which country do I have to file returns in and what other requirements are there?

- When and how do I file a tax return in the US?

- What’s the Substantial Presence residency test and the impact of immigration status on residency?

- What are the tax requirements of a resident vs non-resident?

- What the tax requirements of an Australian that is treated as a resident in more detail e.g. Investment properties, shares/stocks?

- The Tax Treaty between the US and Australia

- FBARs / declaring foreign income + offshore assets

- When is a W-8BEN (or W-9) required?

You can submit questions when you sign up and we will do our best to provide information that will be relevant for everyone who is joining!

Question submission closes on February 2nd, 2024.