The LCA is a form and agreement that your employer will make with the Department of Labor. It takes an hour or two to fill in accurately for the first time, but is relatively straight forward when you understand all of the sections. We've brokendown everything from prevailing wage to employer's name so you can follow through as your employer fills it in, in advance of your visa application.

The LCA itself contains:

- Who the company is and their official tax identification (the only company you can work for in the US under the E3);

- Contact details for a representative from the company;

- The official title of the job they are employing someone for;

- What category that job fits into;

- The prevailing wage code for that position;

- The wage that they will pay for the position (which must be more than the prevailing wage).

All of this leads to a document that, when certified, makes up possibly the most important document in the whole E3 visa process.

Why getting on top of the LCA early is important

At this point, if your employer is slow to file the LCA, it delays the whole process – including your potential start date. Make sure you’re available by phone and email to respond quickly to any questions your employer has. Your start date can't be adjusted once it's certified so put it far enough out to have time to get an interview and enter the US, but not too far away that you need to idle around before starting (because you can only enter the US within 10 days of starting).

Keep reading for some more tips on what start date you should use based on when you get an interview.

Finding out your prevailing wage

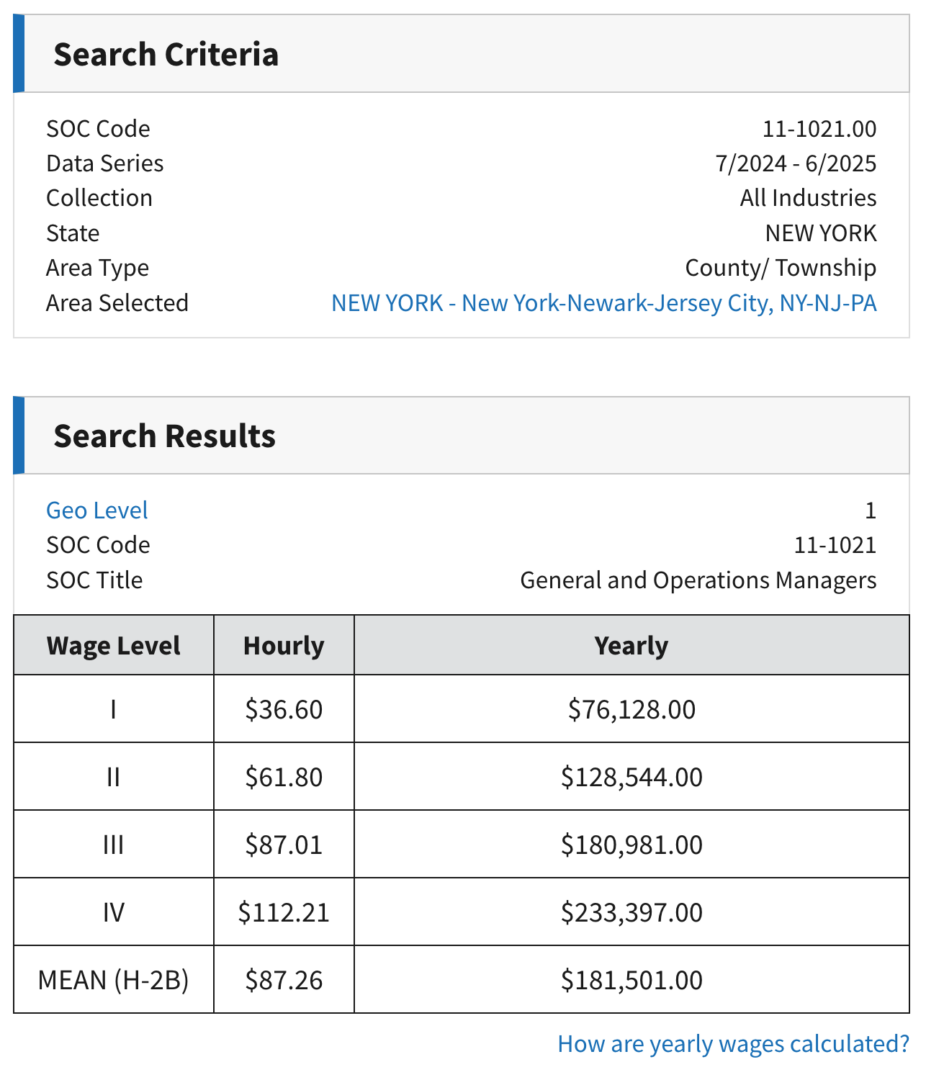

The most complicated part of the LCA is the prevailing wage because it commonly trips people up. You basically need to be paid more than a certain amount of money to qualify. It can be calculated by going to the OFLC Wage Search website and running through the “Wage Search Wizard”. This will ask your state and your county, and then you search or select your occupation from a list.

Once you find the list of job titles on OFL Wage Search, there are a few things to note: first is the code in blue which is the “SOC Code” which you will need later. Clicking that will take you through to ONetOnline, another great resource that can confirm that this title of job requires a Bachelor's Degree (a requirement for the E3) if you scroll down to the Education section. It doesn't need to be 100% but needs to be common that you require a Bachelor's or greater training.

Secondly, you can click “View Wages for” which will show you the levels of wage requirement, and a rate per hour and a rate per year, based on the “Level” (one through four, ignore the Mean Wage). Level 1 means an entry-level experience at this job, level 2 is relevant education and experience, Level 3 is experience employees with a deeper understanding (e.g. management) and Level 4 are experts (e.g. senior management).

You must earn more than this amount for the level that corresponds to your application to qualify. Which level you pick is up to you, and it's best to discuss how this works with an immigration attorney.

How to file the LCA online with the Department of Labor

When they’re ready, your employer will file the form online at Foreign Labor Application Gateway, an online portal. Certification takes 5-10 business days.

While you can assist in the process, they are the ones that will need the login to FLAG and be the ones to actually fill in the form. You are certainly assist them however you'd like, and some people pre-fill in the final form to share with their employer for guidance, but ultimately, they will be the ones submitting and signing it.

The employer then needs to keep an eye on the status of the LCA on the certification website. If you don’t hear anything at 5-6 business days, I suggest asking your employer to log in and check the status one week after the LCA has been filed (becuase the Deparment of Labor are really good at getting things back on time).

Very importantly, make sure that in FLAG, your employer selects the LCA (ETA-9035) and NOT the ETA-9141 Prevailing Wage Determination (this constantly trips people up and leads to delays).

Here's the step-by-step overview (be sure to use the little question marks at every step to ensure that you've though about everything!)

A. Employment-Based Nonimmigrant Visa Information

- A.1. Indicate the type of visa classification supported by this application* – If you're Australian this will be “E-3 Australian”

B. Temporary Need Information

- B.1 Job Title – This is what you looked up in the wage search above

- B.2/B.3 SOC (ONET/OES) Code and Occupation Title – This is also fetched from the Wage Search above

- B.4. Is this a full-time position?* – If this is a full-time position for you, check yes (as opposed to a part-time position)

- B.5. Begin Date* – When will you be starting work in the future if everything goes right (it must be a future date within 6 months)

- B.6. End Date* – When will the work end (make it at least a day before 2 years after the start date)

- B.7. Total Worker Positions Being Requested for Certification* – If this is just for you, this will be 1

- B.7a-f. Basis for the visa classification supported by this application – This one trips a lot of people up but I've defined the categories below (be sure to put all 0s in the ones you don't use)

- a. New Employment – In theory it's only new employment if you're outside the US not currently holding an active E-3 or you're changing status (to an E-3 from something else)

- b. Continuation of previously approved employment without change with the same employer* – This is if you're renewing and nothing has changed

- c. Change in previously approved employment* – This is if you're notifying USCIS that your job title or something else “non-material” to the job

- d. New concurrent employment* – If you're going from one employer to two, this is you

- e. Change in employer* – This is what you'd use if you're moving to a new employer but already have an E-3

- f. Amended petition* – This will be up to your lawyer but this is when there's a more significant change to your previous petition and your material work has changed

C. Employer Information

- C.1. Legal Business Name* – This is your employer's business name

- C.2. Trade Name / Doing Business As (DBA), if applicable – Employer's DBA (which is a public registered name they might be trading under instead of XYZ LLC)

- C.12. Federal Employer Identification Number (FEIN from IRS)* – The EIN is what identifies a business, it's their tax file number equivalent

- C.13. NAICS Code* – This is the category of company, your employer will know this

- C.3. Address 1* – Employer Address

- C.4. Address 2 (apartment/suite/floor and number) – Employer Address

- C.8. Country* – Employer Address

- C.5. City* – Employer Address

- C.6. State* – Employer Address

- C.7. Postal Code* – Employer Address

- C.10. Telephone Number* -Employer Phone

- C.11. Extension – Employer Phone Extension

D. Employment Point of Contact Information

The information contained in this Section must be that of an employee of the employer who is authorized to act on behalf of the employer in labor certification matters. The information in this Section must be different from the agent or attorney information listed in Section E, unless the attorney is an employee of the employer. Just make sure this is who could speak to your application if somebody calls!

This will likely be someone in HR or a manager in a smaller business who is overseeing your application.

- D.1. Contact's Last (family) Name* – Employer contact person's name

- D.2. First (given) Name* – Employer contact person's name

- D.3. Middle name(s) – Employer contact person's name

- D.4. Contact's Job Title* – Employer contact person's name (e.g. “HR” or “VP of Sales”)

- D.5. Address 1* – Employer contact person's business address

- D.6. Address 2 (apartment/suite/floor and number) – Employer contact person's business address

- D.10. Country* – Employer contact person's business address

- D.7. City* – Employer contact person's business address

- D.8. State* – Employer contact person's business address

- D.9. Postal Code* – Employer contact person's business address

- D.12. Telephone Number* – Employer contact person's contact number (ideally a mobile/cell to make sure they're contactable but can be any line related to them)

- D.13. Extension – Employer contact person's phone extension

- D.14. Business e-mail address* – Employer contact person's email address

E. Attorney or Agent Information (if applicable)

If there's an attorney or agent involved in the process who is operating outside of the company, their details go here. It's important to note that by filling this in, the employer authorizes the attorney or agent identified in this section to act on its behalf in connection with the filing of this application. So be sure you know who this person is and they are the attorney or agent on your case (from a third-party, not someone inside your company from D).

- E.1. Is the employer represented by an attorney or agent in the filing of this application?* – If this person doesn't exist, then select NO and leave everything blank in this section.

- E.2. Attorney or Agent's last (family) name – Attorney or agent's name

- E.3. First (given name) – Attorney or agent's name

- E.4. Middle name(s) – Attorney or agent's name

- E.5. Address 1 – Attorney or agent's address

- E.6. Address 2 – Attorney or agent's address

- E.7. City – Attorney or agent's address

- E.8. State – Attorney or agent's address

- E.9. Postal code – Attorney or agent's address

- E.10. Country – Attorney or agent's address

- E.11. Province – Attorney or agent's address

- E.12. Telephone number – Attorney or agent's phone

- E.13. Extension – Attorney or agent's phone

- E.14. E-Mail address – Attorney or agent's email address

- E.15. Law firm/Business name – Attorney or agent's firm or business

- E.16. Law firm/Business FEIN – Attorney or agent's firm or business EIN (Federal Tax ID)

- E.17. State Bar number (only if attorney) – Attorney address State Bar number

- E.18. State of highest court where attorney is in good standing (only if attorney) – Attorney's court information

- E.19. Name of the highest State court where attorney is in good standing (only if attorney) – Attorney's highest state court information

F. Employment and Wage Information

This is where we start to get into the real individual information about you and the role that you're starting. Be very careful with this stage because it's important to your approval.

There's also a very important notice here:

The employer must define the intended place(s) of employment with as much geographic specificity as possible. Each intended place(s) of employment listed below must be the worksite or physical location where the work will actually be performed and cannot be a P.O. Box. The employer must identify all intended places of employment, including those of short duration, on the LCA. 20 CFR 655.730(c)(5). If the employer is submitting this form non-electronically and the work is expected to be performed in more than one location, an attachment must be submitted in order to complete this section. An employer has the option to use either a single Form ETA-9035/9035E or multiple forms to disclose all intended places of employment. If the employer has more than ten (10) intended places of employment at the time of filing this application, the employer must file as many additional LCAs as are necessary to list all intended places of employment. See the form instructions for further information about identifying all intended places of employment.

What this is emphasizing is that the LCA must cover the location you work, and if you're not in a “commutable” distance from that location, then another location must be added. So if you live a long way from your office, you will likely need to show an LCA in your home, or if you are spending a lot of time at two different offices in different states, they both must be listed.

The only places that don't need to be listed on an LCA are if you're off-site for a very short amount of time, and it's not a regular thing at that location. For example if you have to go to a conference for a week, then that's fine, or if you have to make a presentation, you don't need an LCA.

a. Place of Employment Information 1

- F.a.1. Enter the estimated number of workers that will perform work at this place of employment under

the LCA – In most cases this is going to be one because this LCA is only relevant to you - F.a.2. Indicate whether the worker(s) subject to this LCA will be placed with a secondary entity at this

place of employment – In some cases, you might be employed by one company, but then placed at the offices of another company, for example if you're consulting and working under that company. This must be disclosed here. - F.a.3. If “Yes” to question 2, provide the legal business name of the secondary entity – Detail the company who runs the location you'll be working at

- F.a.4. Address 1 – Your place of employment address #1

- F.a.5. Address 2 – Your place of employment address #1

- F.a.6. City – Your place of employment address #1

- F.a.7. County – Your place of employment address #1

- F.a.8. State/District/Territory – Your place of employment address #1

- F.a.9. Postal code – Your place of employment address #1

- F.a.10. Wage Rate Paid to Nonimmigrant Workers – This is how much you will be paid from and To. In most cases, it's just going to be one number, so you can ignore the “To” field, but if you do have a range then you can put these both in. The “From” must be higher than the number in F.a.11.

- F.a.10a. Per (Choose only one) – For the number at #10, is that per hour/week/bi-weekly/month/year

- F.a.11. Prevailing Wage Rate – This value can be determined by doing a lookup on the Occupational Employment Statistics (OES) Program using the OFLC Wage Search here. You need to pick the number that corresponds to the Wage Level that is right for you and that you will insert below at 13.a (see below)

- F.a.11a. Per (Choose only one) – For the number at #11, is that per hour/week/bi-weekly/month/year

- For this next section, you are going to select either 12, 13 or 14, and if you followed my instructions above, you're going to select 13. If your employer got your own PWD from the DOL, select 12, and if you used another survey, select 14 and fill that in.

- F.a.12. A Prevailing Wage Determination (PWD) issued by the Department of Labor – For this you would have filed a separate determination which can take some time to come back, so you likely haven't done this unless you had some reaosn to.

- F.a.13. A PW obtained independently from the Occupational Employemnt Statistics (OES) program – This is related to the OFLC Wage Search above, and you will select the box on the left.

- F.a.13a. Wage Level – See the top of this article where we talk about Wage Levels

- F.a.13b. Source Year – This is contained in the top of the right column of your result

- F.a.14. A PW obtained using another legitimate source (other than OES) or an independent authoritative source – Honestly, if you need this, you especially need a lawyer

You will repeat this whole section for every location you will be working at.

G. Employer Labor Condition Statements

This instructs you to read and understand a number of requirements.

Read them, understand them, then:

- G.1. I have read and agree to – Mark this as “Yes”

H. Additional Employer Labor Condition Statements

This is only for H-1B employees, so if you are on an E-3, skip H entirely.

I. Public Disclosure Information

- I.1. Public disclosure information in the United States will be kept at: – As per section G above, this section requires you to select where you will be displaying the LCA. Select the appropriate one or two.

J. Notice of Obligations

- J.1. Last (family) name of hiring or designated official – So just like the sections above, the employer must be listed here and this time it's the person legally taking responsibility for your employment and LCA compliance.

- J.2. First (given) name of hiring or designated official – Details of the employer

- J.3. Middle initial – Details of the employer

- J.4. Hiring or designated official title – Details of the employer

- J.5. Signature – The employer needs to sign the certified LCA document with a real signature, but the signature can be printed or photocopied — it no longer needs to be a wet ink signature.

- J.6. Date signed – Date of the signing (post certification)

K. LCA Preparer

- K.1. Last (family) name – You only need to fill this in if the person in D or E are not the person who actually filled this in

- K.2. First (given) name – The LCA preparer's details

- K.3. Middle initial – The LCA preparer's details

- K.4. Firm/Business name – The LCA preparer's details

- K.5. E-Mail address – The LCA preparer's details

The rest is not for you, don't worry about any of this!

How to check the status of your LCA

If you want to check the status of your LCA yourself, use the LCA number you received above and go to Foreign Labor Application Gateway.

If it still says certification is “in process”, I recommend having your employer check back daily to make sure the process moves as quickly as possible.

Hi Josh, I have two questions:

1. My current E3 visa expires on Jan 31, 2026, I plan to go back to Australia to renew/extend, (not sure which term to use) my visa with the same company. Do I apply for an E3 or E3R?

2. On my LCA, on Section B, question 7, does my employer choose “New Employment” or “Continuation of previously approved employment without change with the same employer” if I am applying outside of the US in a consulate in Australia?

Sincerely, Ivan

Hi Ivan,

I had the same question! Did you ever get answer elsewhere?

It’s effectively the same, but you would be E3R and Continuation if it’s the same employer, title and job, yes.

I’ve referred to this so many times. Thank you so much. Most comprehensive guide out there.

I’m so glad!!

Thank you so much Josh! Super helpful, have shared this article with my employer!