The last thing on your mind when you head to your holiday parties in December is tax, I know, but as the year draws to a close, it's important to take a quick minute and prepare before year end. Getting organized early can help ensure a smoother process and possibly better tax outcomes (and most importantly avoiding any traps). To help you out, we've created a checklist for everything you should consider before you raise a glass to 2025.

Whether you're an individual taxpayer, a family member with dependents, a freelancer, or something in between, it's important to know that there are going to be a wide range of questions you're asked by your accountant or in tax preparation documents. It's also possible that there are things you should have done before year end, and we don't want you to miss the window!

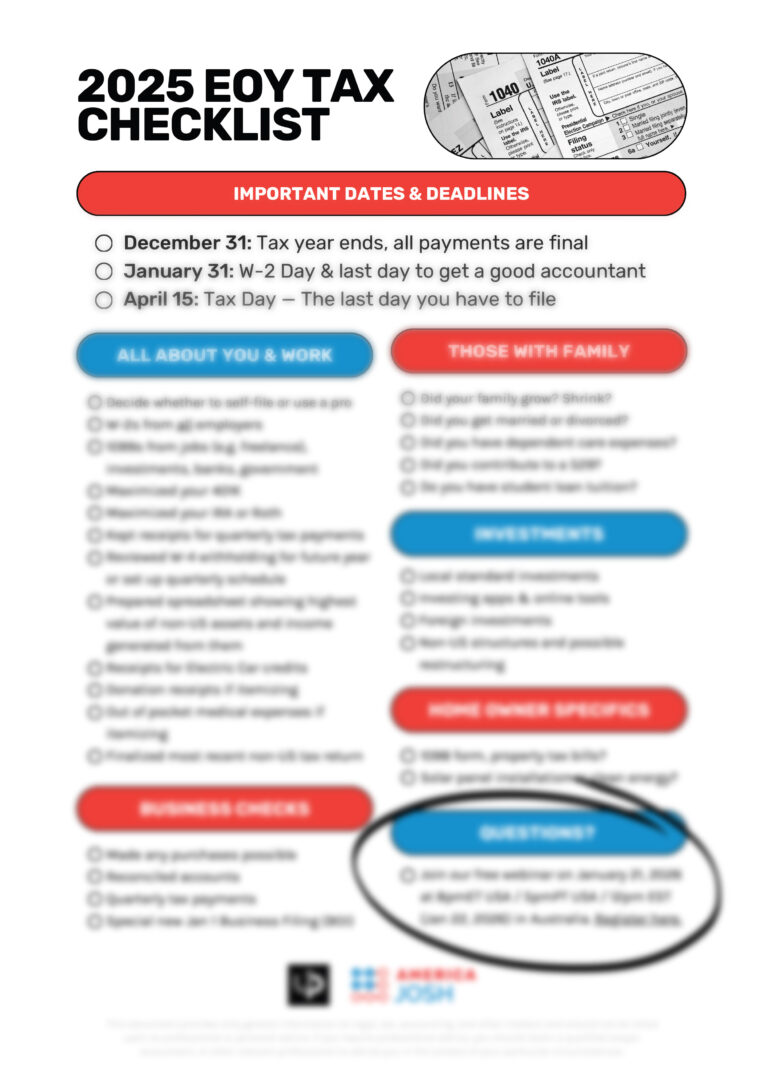

Download the 2025/26 tax checklist

Here's the ultimate checklist for what you need to sort out before the year ends.

Included in the checklist is

- Key dates & timelines

- Changes for 2025/26 tax year

- Individual and work requirements;

- Considerations for family members;

- Specifics for business owners and freelancers;

- Checklists for investments and receipts; and

- Some extra tips to make things work smoothly.

Ready for more? Watch our 2026 Tax Webinar!

- 00:00 Welcome and Introduction

- 01:43 General Advice Disclaimer

- 02:34 Common Tax Mistakes and Traps

- 03:20 Introduction to Uptrend Advisory

- 04:56 What's New in 2025-2026 Tax Year

- 11:59 Understanding US Tax Residency

- 14:56 Filing Taxes as an Expat

- 23:13 Reporting Foreign Assets and Income

- 28:27 Superannuation and US Taxes

- 31:05 Understanding FBAR Requirements

- 31:26 Introduction to Form 8938

- 32:30 Explaining W-8 and W-9 Forms

- 33:26 Buying Property on an E-3 Visa

- 35:37 Collecting Tax Forms in January

- 39:32 Green Card Tax Implications

- 43:25 401(k) vs. Superannuation

- 45:13 Capital Gains and Inheritance Taxes

- 49:40 Important Tax Deadlines and Extensions

- 51:22 Working with an Accountant

- 54:29 General Tax Minimization Strategies

- 58:07 Conclusion and Q&A