You spend the first few months (or years) of your time in the United States trying to build credit and get your first credit card, but once you get the first one, you'll notice that they start coming in thick and fast. With all of these cards come benefits and reward programs like cash back, flight perks, travel perks, and more. So how do you keep track of all of these and activate all the best deals?

You'll find lots of resources for tracking your spend, and helping you with suggestions, but which ones should you listen to?

Everything you need to know about credit card rewards

A note about credit cards in general

I want to make sure that before I dive into the benefits of credit cards and the rewards that companies attach to them, I write a little note about credit in general.

Credit is hugely important when living in the United States, whether you like it or not. If you've read anything I've written about credit scores, then you'll know that without a good one you're going to have trouble with everything from renting to insurance. Life gets more expensive if you have poor credit, as terrible as that is.

That all being said, I know that credit cards aren't familiar to everyone, and many are vary wary of using them at all, and I understand. The concept that your credit limit can be automatically increased to tens of thousands of dollars for many means a red flag for their future savings, and one that can get them into horrible debt.

Don't do anything you're not comfortable with, and don't get a credit card until you know how to use it wisely. My tip: Use it like a debit card. Turn the credit limit right down (you can request this at your bank) and pay it off, in full, every time you use it. Go out for dinner? Pay it off in the morning. Buy some shirts? Pay it off that afternoon. Don't let the money accrue and you'll be fine.

Having trouble with debt? Click here to read the Federal Trade Commission's Consumer Advice about How to Get Out of Debt.

What are credit card rewards?

Every different credit card on the market pitches itself at a slightly different audience but nearly all of them have a certain array of rewards and benefits. The point of these rewards are to attract you to use their credit products, and ultimately pay interest on those cards.

You can, however, gain a benefit from these rewards effectively without cost to you, if you manage the credit of your card well, never end up owing interest, and activating every opportunity you can.

Examples can include credit at particular stores, cash back on purchases, reward points for airlines, shopping points that can be exchanged for goods and services, and more.

Automatically activate credit card rewards

While many of the benefits come with the card and are active as soon as you activate the card, there are some that change on a rolling or monthly basis and actually require manual activation. If you login to your bank account you might see something that looks like a range of checkboxes or a list of links – these are all the deals that they have on offer to you.

When they advertise the cards, they talk about all the rewards you get, but in many cases, it's on you to actually be vigilant and turn them all on so you get the full reward… until now!

What I've found though is an app, Max Rewards, which does this for you:

This app allows you to login to all of your bank accounts, select which credit cards you've got, and then scans them for the benefits and rewards available. It then goes through and activates all of them for you and makes a comprehensive list of what's on offer from all of your cards in the app.

The App is free but does require you to signup for Gold to get all the benefits, so use the following code to get a month to try it out for free:

? Hey! I use MaxRewards to manage my cards, monitor my credit scores and maximize my rewards. Use my code (fq86), on signup to get 1 month of premium benefits for free ?

MaxRewards App

For me, this meant unlocking multiple cards form multiple banks, and each week I log back in, push refresh, and it does it all again for me. It also lists all the balances on my cards, the points I've earned, and the rewards I've utilized so far.

From a security standpoint, this app uses the appropriate “Plaid” methods to connect your bank accounts so that you never have to give the Max Rewards app your username and password directly (never do that). This means it can interface with the bank but needs your permission with a code each time you refresh.

How to know which card is worth the most points when you buy things

Another thing I didn't even think about was that when you're buying things, you should be changing up cards along the way depending on the perks associated with where you're at, and to make sure you're not leaving free value on the table.

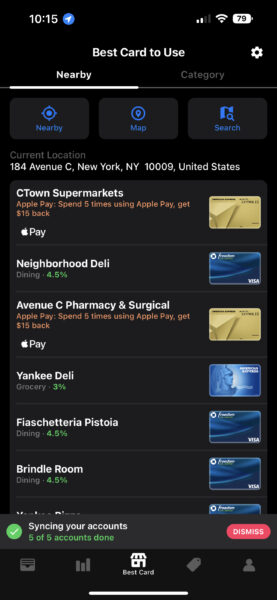

The Max Rewards app has a whole page dedicated to this which actually tells you, based on the cards in your account, which card is best to use at that time, to get the most rewards.

It will tell you all the surrounding locations, venues, and which card gives what return. For example, in the screenshot, you will see that I'm nearby a supermarket, and my Apple Pay card gets the best cash back, whereas, the Deli would be the Freedom card for 4.5% cash back for dining!

How to get value for money from your credit cards

Many of the credit cards on the market have an annual cost. This means that it can cost hundreds of dollars simply to own the card, as a way for the bank to offset the rewards and benefits you get from using it.

Don't let this number put you off straight away though.

In many cases, you can get more benefit from the card than it might cost, even if that cost is hundreds of dollars per year. In my case, one of my credit cards, the Chase Sapphire Preferred costs $95/year, but

The one big tip is look for cards that give you benefits for things you already do, companies you already purchase things at, and services you already subscribe to. Don't look at it like a shopping list.

The deals they offer are generally “spend $x and get $y” back, which only works if you were already spending $x. If you spend $x to get $y you've probably spent more than you did last month, which is a net negative for you.

If you can't make the math work without changing anything, then that card is not for you.

What credit cards do I recommend?

Here's a list of every card that I've currently got. I've been banking with Chase since I first moved to New York because there are ATMs everywhere and the cards seemed to have good benefits for the cost.

I also have an AMEX for business purchases, and a Delta AMEX for the flight and travel benefits.

But again, look into the options that are best for you, and shop around!