Included in the Australian budget 2021/22 are some proposed changes to how tax residency is determined in Australia. Now, this might sound dull and not something you need to worry about but we've pulled apart what exactly is going on, and what changes for expats, and it could have a massive impact!

Jason Stoch (UpTrend Advisory): Two new rules to simplify your tax residency, or is it

Josh Pugh (America Josh): Hi everyone, I'm America, Josh and welcome to tax residency with Jason Stoch from UpTrend Advisory. Get Jason, how are you?

Jason Stoch (UpTrend Advisory): Hi, Josh. Thank you. I'm doing very well. Thanks. Thanks for inviting me to the session. I hope everything's been well with you.

Josh Pugh (America Josh): Not too bad at all. It's sunny outside, so I really can't complain whatsoever.

Jason, so we've, I mean, I've certainly heard a bunch of people talking about this new tax residency rule. That's been proposed by the Australian government and I've had a whole bunch of frantic emails. So thank you very much for jumping on to quickly go through sort of what's been proposed and what might be changing in the tax residency space.

I know it's an exciting one that that everyone's always keeping an eye on. I want to flag this hasn't come in yet. So everything we talk about today, they're not changes that you know, you need to worry about right now, but it is something that, that might come in Jason to start. Do you know when, like, do we have any idea about when this might happen before we even get into the changes?

Jason Stoch (UpTrend Advisory): Yeah. So it is. Like these new rules came out with the new budget. And so the assumption would be that they take effect from July if they do go through.

Josh Pugh (America Josh): Okay. So the very soon as it could be July this year, but realistically with the way that policies and things push through, it could be next year. It could be the year after we don't know for sure, but it's something to be aware of right now so that people can get prepared.

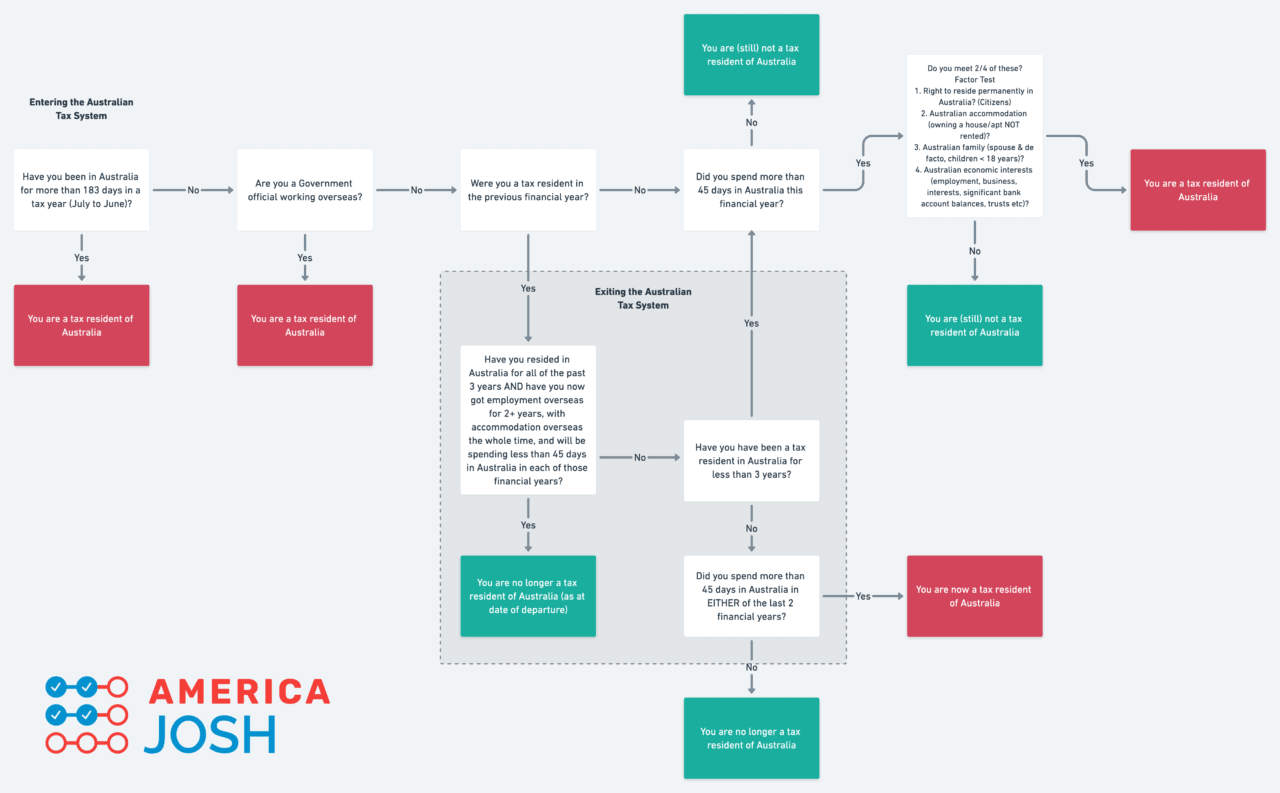

So. In saying that you and I worked on a bit of a workflow that we're going to put on the screen right now, so that people can track because some of these things can get a little bit confusing, but I'm going to work through with you each of the steps. And we can, we can jump right in. The first thing that I think we want to flag is this w when we talk about years, are we talking about financial years or are we talking about calendar years?

Cause I know for example, in the U S you've got different rules than Australia.

Jason Stoch (UpTrend Advisory): Yeah. So it is based on the Australian financial year. I know everyone in America is now used to the calendar year, but we have this exercise need to go back. And so that June 30 year end mindset.

Josh Pugh (America Josh): Okay. So we're going to go to the very start of our workflow talking about entering the Australian tax system.

So this is testing whether someone who. Isn't yet engaged in the Australian tax system or, you know, has yeah. Was, is, is out of it. Does, do they qualify to become a tax resident of Australia? So over to you, first question.

Jason Stoch (UpTrend Advisory): Yeah. So this is very similar to the substantial presence test in America, but it's essentially saying in the financial year, have you been in Australia, physically for 183 days or more, and that will hopefully help.

Majority of everyone within a residency, but if yes, you're a tax resident of Australia. If no, then there are further underlying tests.

Josh Pugh (America Josh): Okay, awesome. Easy 193 days in the country. You're a tax resident. So if, no we get to the second one around, are you a government official working overseas?

Jason Stoch (UpTrend Advisory): Yeah. So think about the Australians working at consulates and things like that.

If that is you and you are a government official, you are still an Australian tax resident. If not, then we move on and yeah, it becomes a little bit more complicated.

Josh Pugh (America Josh): So this is where we introduce some of the bits around the, I know people may have seen the bright line test. So that's sort of the, where we start to get into this workflow.

So the next one is where you a tax resident in the previous financial year. And as we've gotten our little workflow, We've got a yes. And that's around exiting the Australian tax system. So we're going to come back to that because we want to start with the first bright line test, which goes, so you say where your tax taxpayers and then the previous financial year?

No. Did you spend more than 45 days in Australia? This financial year?

Jason Stoch (UpTrend Advisory): Yeah. So this whole section of the workflow is. Targeting people who are not tax residents and want to make sure that they're still not tax residents. So under these proposed new rules, you've spent less than 183 days in the financial year.

You are not a tax resident in the past financial year. You did not spend 45 days. In Australia, this financial year, you are not a tax resident of Australia. Again, you'll find, but if you did go on a holiday and you are stuck in Australia due to COVID or other things, then you need to apply these new factor tests.

There are four factor tests and you only need to meet two of them to be deemed a residence. Whereas if you do not meet two of them, you are still a non-residents. So these factor tests the right to reside permanently in Australia. So if you are a citizen or a permanent residence if you own Australian accommodation, such as an apartment or a house, If you have Australian family, and this means spouse, defacto and children under 18, or if you have Australian economic interests.

So the two that will most likely catch a lot of people is the accommodation and the economic interests. So the accommodation, if you own a house or an apartment, and it is not rented out, Then you satisfy that test and if you're an Aussie citizen, then okay. You are now. Yeah,

Josh Pugh (America Josh): no, that's true. I'm saying that's to you.

If you've got a combination and if you've got the right to reside, so every citizen does, you've hit to your S you're suddenly boom, a tax resident.

Jason Stoch (UpTrend Advisory): Yeah. Whereas prior to these changes, you would not have been The other one that will catch people is the economic interest. So if you have employment income from Australia, if you have, you know, a business in Australia, a trust or a lot of money sitting in bank accounts that would qualify as economic interests.

And so suddenly you're an Australian tax resident of the game. Because you met the two out of the four tests.

Josh Pugh (America Josh): Yeah. Yes. Come on. You know, certainly that you and I have talked about that a lot of people, you know, might have an investment, so it might have, you know, some, some money put away or family trusts or, you know, all sorts of things and all sorts of reasons that might sort of be shown as tying you to Australia.

So suddenly you're an Australian citizen, you've got some ties financially or economically to Australia. Yeah, tick, tick. And if you've spent 45 days there, which I think the real thing that's worrying, a lot of people right now is around the like 14 days quarantine. And if you have to go back to Australia and then you have trouble leaving, because it's difficult to get flights and things, suddenly you hit 45 days and you need to be aware of that.

It's because suddenly, you know, if these do pass, you'll suddenly become a tax resident and and be hit by the ATO basically.

Jason Stoch (UpTrend Advisory): And I'm hopeful not to get political, but I'm hopeful. That's these proposed changes will be shared with people in the relevant space that can hopefully extend the 45 days.

You know, it's a 60 or 90 to make it a little bit more flexible with people in those situations, but you never know.

Josh Pugh (America Josh): Okay. So yeah, basically. The proposed thing is around 45 days inside Australia, physically. Plus two of those tests, you become a tax resident. So then the second part of what was proposed is around this adhesive residency or sticky residency.

And this is around people that, so if you are a tax residents, a resident in Australia, how do you shed your tax residency? So in the past, if you went overseas and you lived overseas, for example, in the U S more than 193 days, You you know, you're no longer a tax resident, whereas now, as I understand, they're making it a bit more difficult to get rid of that tax residency.

Is that right?

Jason Stoch (UpTrend Advisory): Yes. So they've added something called the overseas employment rule where you know, and the, in the bottom section of this workflow we'll get into it, but you are a Australian tax resident the past year? Yes. Okay. Now, in order to exit the Australian tax, System, you need to apply the overseas employment rules.

So what that role is, is you've resided in Australia for all of the past three years. You now have overseas employments. That will be more than two years and you have accommodation the whole time. Or your overseas employments. The other piece is that you will be spending less than 45 days in Australia in each of those financial years, you're overseas.

If you can satisfy all of those tests, you have exited the Australian tech system on the date of departure. If not then as further tests to be applied.

Josh Pugh (America Josh): Yeah. For someone who does get a job for more than two years and moves overseas. And the whole point is to be overseas, you know, forever and ever you know, conditions apply on immigration and things at the other end.

But if that's the plan, then you are no longer a tax resident. You do sort of shed that tax residency. But if you are, for example, on an 83 visa, that might be less than two years or just under two years and you potentially are coming back. This is sort of looking like it's something around, you know, those kinds of people who will potentially keep the tax residency.

So if you say no to that one in our workflow, and then the question becomes, have you been a tax resident in Australia for less than three years? So if that's, yes that goes back to the 45 day tests. That's we already discussed that one. So you can go down that Merry path, but so just explain to us what happens if it's no.

So this is someone who might have been a tax resident for much longer than three years. So an, an Australian who's who's now moving abroad.

Jason Stoch (UpTrend Advisory): So in that situation where they've been a tax resident for more than three years but they couldn't pass all of the overseas employment tests of the prior one.

Then it's simply a matter of the 45 days in the last two financial years in either of the two financial years. So if you have not spent 45 days in either of the last two financial years, then you have a clean exit, but if it's not, then you would still be an Australian tax residence.

Josh Pugh (America Josh): Okay. So. Yeah, no, I mean, it really sounds like.

So if someone's been living in Australia, their whole life paying taxes and being there the whole time, and now they're looking to move away for less than that two years or less than two years for the job, you're going to be sort of step you're going to stay under the tax residency rules in Australia.

You're going to keep paying tax to the ITO. That's sort of the real crux of it.

Jason Stoch (UpTrend Advisory): Yes. Yeah. So overall, the B's rules are more restrictive than prior, and it does give some simplicity from the 183 day test. But all of these underlying tests. Do add complexity to everyone's situation that should be carefully managed and plans that you can avoid residency.

If possible. Obviously if you're trying to enter residency, you at least now know how you can, but the, these roles are.

Josh Pugh (America Josh): Yeah. Potentially potentially change a lot if if that comes through. So we'll certainly keep an eye on those and yeah, we'll make sure that we're updating this page and updating videos.

If we hear that actually comes out and or if there are any revisions that I'll, I'll be sure to check in. Thank you, Jason stock from uptrend advisory. I really appreciate you taking the

Jason Stoch (UpTrend Advisory): time. My pleasure. Thank you, Josh. This is, this was fun.

Josh Pugh (America Josh): Thanks.

Jason Stoch (UpTrend Advisory): Bye. Bye.