Transferring money internationally is an expensive and confusing process the first time you try but if you know where to look, I can help you transfer those Australian Dollars ($AUD) into US Dollars ($USD) in no time! There are all sorts of companies competing for your money using promises of best FX rates and “no-fee” transfers, but which ones are actually worth it? I've compared them!

From my research, I found that there are six major players when it comes to transferring money internationally: OFX, Wise (formerly “Transferwise”), CurrencyFair, WorldRemit, XE.com and PayPal. This isn't even to mention the major (and minor) banks that offer international trade services (or other financial institutions).

I'll go through the pros and cons of each and compare the amounts of money that you can expect to receive for a $1,000AUD transfer at the time of writing as an example!

I'm using Australian dollars as an example, as I am an Australian living in the United States myself, but these should work in this order for all directions in many different currencies.

How to transfer money internationally

- #1 OFX – Best way to transfer money with my special America Josh Rate

- #2 Transfer money with Wise (formerly “Transferwise”) – 2nd Place

- #3 Transfer money with WorldRemit – 3rd Place

- #4 Transfer money with CurrencyFair – 4th Place

- #5 Transfer money with XE.com – 5th Place

- #6 Transfer money with PayPal (Xoom) – 6th Place

- Transfer money internationally with Banks

- Should I transfer money internationally with Citi or HSBC?

- What about Xoom and MoneyGram?

- A note about “market rates” and “mid-market rates”

- The last thing to remember

#1 OFX – Best way to transfer money with my special America Josh Rate

$1,000AUD in $USD with OFX is currently = $771.90USD (Your rate: 0.7719)

This is who I personally use to do all my international money transfers!

This is the best rate that I've found online so far. This rate I have used is actually slightly better than the normal customer rate because we have a special OFX community for America Josh Readers that offers this slightly more competitive rate.

If you'd like to sign up for this rate you can do so online: This will take you through the signup process and you will be put onto our special FX rate.

Option 1: Sign up for OFX online for the best value online transfers

Alternatively, for those of you who want to talk to a real person (maybe you want to transfer a greater amount of money for example) then we've got the awesome Amelie at OFX! Amelie can give you the same awesome rates for being such an awesome America Josh reader, and can also answer your questions via phone or via email.

"*" indicates required fields

#2 Transfer money with Wise (formerly “Transferwise”) – 2nd Place

$1,000AUD in $USD with Wise (formerly “Transferwise”) is currently = $770.49USD (Your rate: 0.775150 + $6.01AUD Fee)

As you can see, it's very close to our special OFX rate, but not quite the same.

As above, the transfers are almost instantly in your bank account. There's again a quick signup process to confirm your identity. You can get your first transfer for free and help me out by using this referral link to sign up!

Wise (formerly “Transferwise”) is a big company and markets a lot, so you will hear about them a lot.

#3 Transfer money with WorldRemit – 3rd Place

1,000AUD in $USD with WorldRemit is currently = $767.71 (Your rate: 0.76771 + $3.99AUD fee)

WorldRemit describes its rates quite oddly because when you type in “I want to send $1,000” it says “That will cost $1,003.99” which seems, in my opinion, to be a devious way to confuse people. I have reverse-engineered the numbers.

#4 Transfer money with CurrencyFair – 4th Place

1,000AUD in $USD with CurrencyFair is currently = $767.70 (Your rate: 0.7717 + $4 fee)

CurrencyFair was suggested by a reader and is widely mentioned across the internet, and as you can see, it's close but not quite there.

#5 Transfer money with XE.com – 5th Place

$1,000AUD in $USD with OFX is currently = $759.59 (Your rate: 0.7596)

Another step down in actual returns when looking at XE.com, another popular transfer method. This one doesn't cost a fee, and is another good competitor in the space!

#6 Transfer money with PayPal (Xoom) – 6th Place

$1,000AUD in $USD with OFX is currently = $743.47 (Your rate: 0.7435)

This one just really is way off the mark and while there is “no fee” if you transfer internally within PayPal, their rate is not helping you at all. Another big name in the market that's not worth it as all!

Transfer money internationally with Banks

The most important thing to remember when transferring money internationally is this: Keep your eye on the final numbers and the amount you will actually receive in your bank account.

“No fee” transfers are great, except for the fact that they are in most banks' cases making this up by giving you a rate that is not as competitive. Effectively taking a fee through another means.

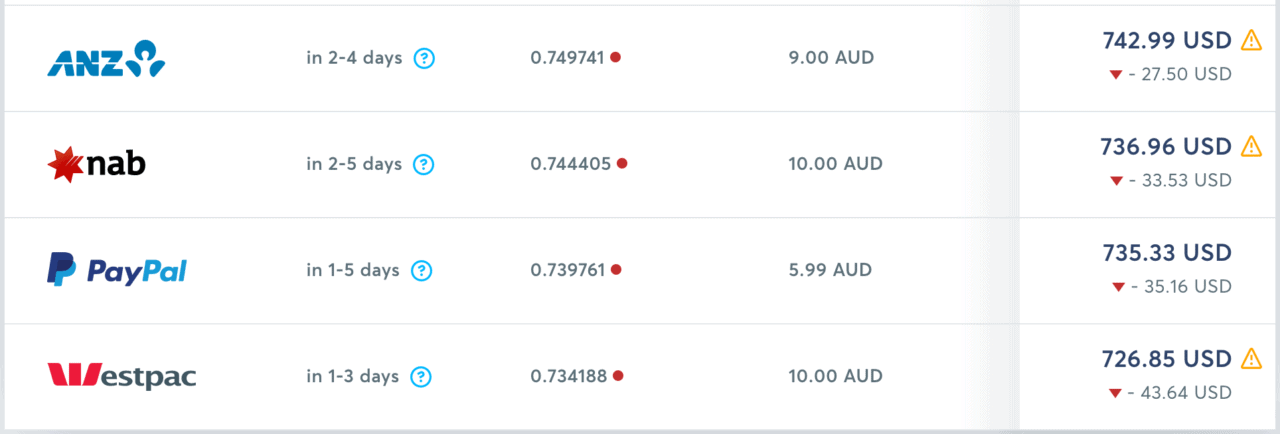

Here's a chart comparing, for example, the major Australian banks right now:

All of these appear to charge rates in addition to an exchange rate that is not comparable to the ones you saw above. Be careful!

Should I transfer money internationally with Citi or HSBC?

When researching this topic, a number of people mentioned Citi and/or HSBC as a good way of transferring money because you can do it internally within their own special systems “without fees”. As they are large international banks, they appear to have a benefit over the rest of the market.

The best thing you can do is compare these for yourself.

In my personal experience, I have not seen their rates to be as competitive as those offered above, but I do know that for those in elite or higher plans with these banks, there can be value found in them.

What about Xoom and MoneyGram?

Both of these services offer reasonable transfers from the U.S. to other countries only.

Right now $1,000USD will get you:

- $1,268.70AUD with Xoom (consisting of a rate of 1.2687 and fees ranging from $30.49 – it's a bit confusing)

- $1,248.86AUD with MoneyGram (consisting of a rate of 1.2488 and fees ranging from $1.999 to $14.99)

I would still recommend using the services above as their rates are still better:

- $1,283.60 with OFX (consisting of a rate of 1.2836)

- $1,279.02 with Wise (formerly “Transferwise”) (consisting of a rate of 1.28966 and fees of $8.25USD)

A note about “market rates” and “mid-market rates”

One thing to note first is that many comparison money sites will list a “Market [or mid-market] rate” at the top and allow you to enter some numbers to see how much your money is worth. But be careful because this is effectively a marketing strategy and you will probably see something like this text underneath:

“All figures are live mid-market rates, which are not available to consumers and are for informational purposes only. To see the rates we quote for money transfer, please create an account.”

This rate is not really indicative of how much money you will actually receive because, in order for an FX company to function, they need to take a cut. This cut can take the form of the transfer rate being slightly lower, fees, or both.

The market rate for the purposes of this post was: 0.78 where $1,000AUD in $USD = $780.00USD. Want to know more about mid-market rates and how FX works? Click here!

The last thing to remember

I know $5 here or $10 there might not seem like much when it comes to picking who to transfer your money internationally, however, with a move internationally, you will probably be transferring more and therefore the decimal point will move to the right at least one, if not more, digits. $5 suddenly becomes $50, $10 becomes $100, and missing out on $25 is now missing out on $250… not an insubstantial amount of money!

Remember: Look for the final amount you will receive and compare that moment to moment. That's what matters.

G’day Josh!

Quick question (I did send an email also, but figured there are potentially others in the same boat)

If I Already have an OFX account, how do I access teh better rate? I’ve been using OFX for a number of years now

Thanks

If you fill in the form and include that detail they can move you over!

Hi Josh,

As an Aussie who has been here going on 30 years (in Boston) I think having a look at Moneycorp might be useful. They have a real live person at the end of the phone and a live body who is in charge of your account. Their rates are slightly higher than Wise but have better service, though I like the simplicity of the Wise account set up.

Wonderful, I will check it out!! Thanks!

Hi Aussie Josh in America,

(I would normally delete anything from an American on these matters, but reading on I found you are a reliable Aussie like few of us expats from Underdown in the collapsing civilization (or decivilisation).

I use Commonwealth CBA to transfer to my Chase account. Of course a fee is involved, from $6-$21 (cheaper if you transfer in the receiving countries currency or the converse I don;t remember, I just choose the cheaper option). I often check the rates online at Currency Conversion sites and CBA seem not too bad. Of course, damn CHase charges a fee to receive (how to avoid that? they really did reverse the charge to yuo? what is the line or trick you used). So you do not mention CBA which is the largest and semi-controlled bank in Aus Others might go the way Silicon Bank went so better to support CBA, Lucky Country’s own national bank, the like of which US does not have. I needed a loan recently back home to do some extension on my country home there, and CBA was very helpful. So what do you think? OFX is still your choice? By the way, how do we get a discount on OFX using your credentials you list in your recommends?

I am in the West coast, do you have a similar online help mate in the Bay Area (San Francisco and adjacent shires/counties)?

Thanks mate; do drink like a lizard for me at the Soho pub!

Purush

Hi Purush, thanks for your feedback! CBA is a great bank, and I still bank with them myself, but the rates for international transfers aren’t ideal. I do believe in using them as a bank, and storing your money with them, but using a third party to simply route the money between accounts (not holding it at any point). If you fill in the form, you can get my special rates!

As an update for those that have used Citibank AU Citibank US transfers – NAB recently acquired Citi Australia so the instant, fee-free transfers between your two accounts is no longer available.

I’ll likely be switching to OFX now.

Hey Josh,

May want to update your wise referral link as it’s broken (it’s missing the .com) ?

Ooh thank you!!

Josh, if money is currently in a large Australian bank how do we get it transferred via Sosefo at OFX?

Hi Astrid! When you sign up for OFX, you get an account. You login, you type in how much money you want to transfer and it asks for which account you want it deposited into. Then they give you a BSB and Account for you to transfer the money to!

I used to use OFX (with the America Josh preferred rate) but after a while my transfers started taking up to 7 days + to move from the US to Aus (initially it was about 3-4). So I switched to Wise. It might cost me $5 but the money is usually available in 2 days.

Thanks for the note, Kirsty! I’ll be sure to check into why it’s taking yours so long! I’ve not had that experience myself and the rate difference was always worth it but really appreciate your feedback!

Hi Josh – do you have any recommendations for tax accountants to move a large sum of AUD to USD? I’m guessing there must be tax involved.

And thanks for the great tips, very helpful

Hi Emma, there shouldn’t be any tax implications if it’s your own money as far as I know, but don’t trust me, trust Jason Stoch at UpTrendAdvisory.com!!

Do you know of any banks (without having the top premium account type) in the US that allow you to receive an OFX transfer from Australia without a fee?

Hey Jess! I’ve had luck in the past asking Chase to reverse the charges once they come in, but nothing consistent sorry.

Thanks for these tips Josh! Just wondering, what are your thoughts on simply withdrawing money at a US ATM from your Australian account (which will spit out AUD), and depositing it right there and then into a US account? How competitive is this, typically, in comparison to these electronic transfer options?

Hi Michelle, you’re very welcome! So in the vast majority of cases, you’re still going to lose out dramatically. The rate you get is still going to be the bank’s rate (if not worse because of the “convenience” element) and therefore you’re missing out on hard-earned dollars!