Since moving to the United States, I've had one primary bank account with one bank. While I've had a range of credit cards and financial accounts, my “checking” account or everyday account has been held with Chase and the money that use to pay for everything has come from this account. My pay has gone into this account, my credit cards get paid from this account, and the card I carry in my wallet is for this account – until Chase closed it, and won't tell me why.

Updated 8th May, 2024 with Response from Chase (see below).

My finances are relatively boring, honestly. I've had the same everyday banking account in Australia before moving to the US that I've had since I was 6 (shout out to my Dollarmite account friends!) and I have never really thought about it in great depth.

When I started a business, I opened a new account, and when I wanted to put some money aside for savings, I did that too, but at no time did I think that relationship would end without my ending it.

So I replicated this behavior in the US, after moving to New York in 2017 I walked into a Chase Bank branch and I opened a Chase Total Checking account.

Why did I start banking with Chase?

The banks are everywhere in New York City.

Chase ATMs are basically more prolific than Starbucks, on every street corner, and conveniently placed wherever you might need them. So it made sense to bank with the big institution that could keep my money safe!

They had all the accounts I needed, the banking app was good and modern and feature-filled.

How was my relationship with Chase?

Utterly delightful. Truly, I've only had good things to say, and as much as you can love a bank, I loved Chase!

I liked them so much that after keeping a Total Checking and a Freedom Credit Card with them personally, when I started my first business, I opened a Chase Business Checking account with them, and then I opened a Chase Business Credit card with them. When I started a second business (America Josh), I opened another account with them, and another credit card too.

All in, I had two personal accounts (one on my own, and one joint with my wife), two business checking accounts, two business credit cards, and three personal credit cards (two on my own, and one joint with my wife).

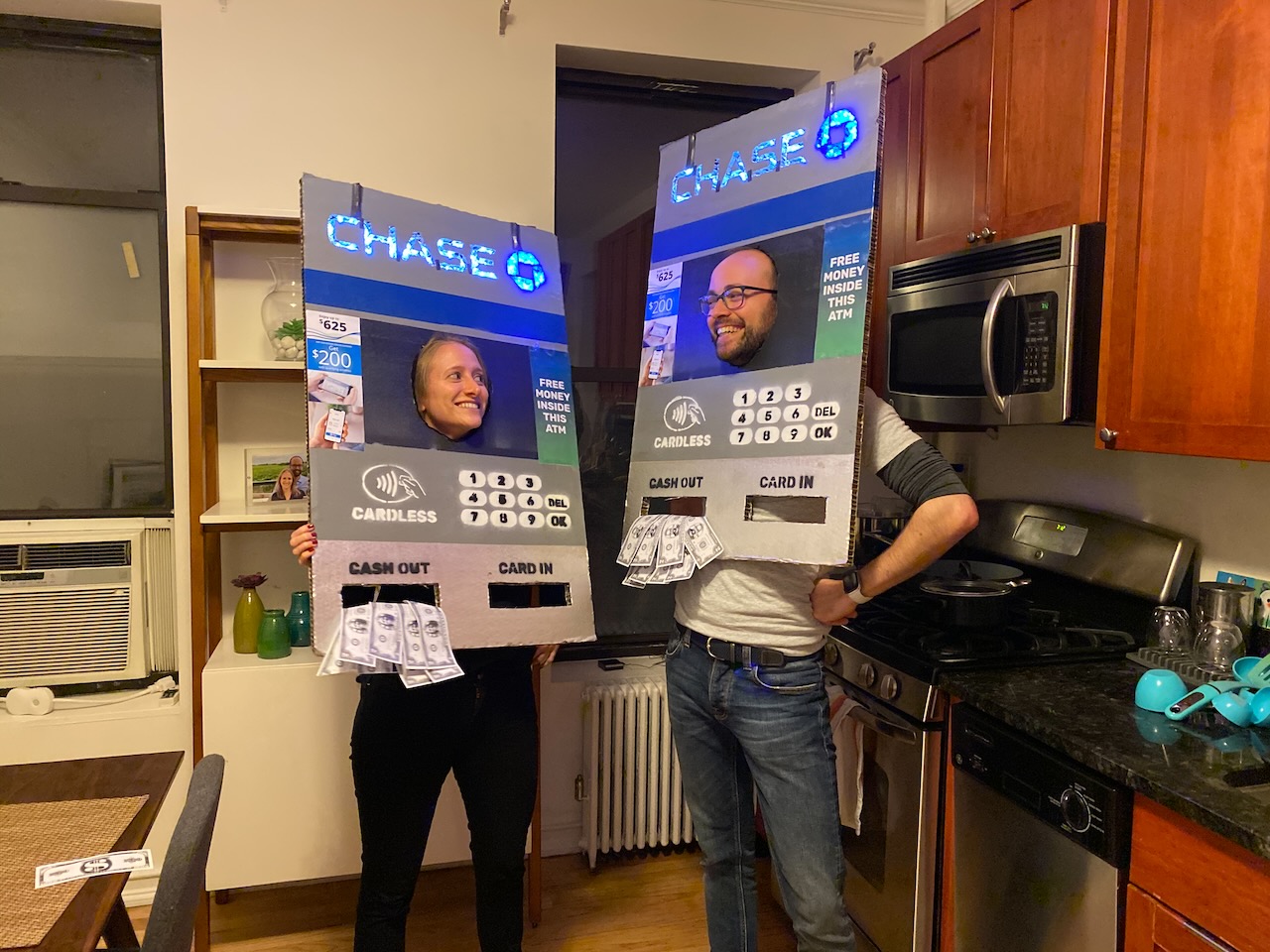

How much did I love Chase? CHECK OUT OUR HALLOWEEN COSTUMES FROM LAST YEAR

What went wrong?

On April 22 I received a notification in my email saying:

Important: Please contact us – To help protect against fraud, we restricted and may need to close your account soon.

At Chase, we’re always working to keep your money safe. Due to recent activity, or because we need more information from you, we have restricted your account(s) and may need to close it soon. This includes your account(s) ending in: XXXX

Now, this in and of itself was not too much of a shock, because this has happened before and I've called, confirmed that the recent transactions are mine (e.g. moving a larger amount than normal to a savings account) and everyone goes on their way.

However this time, when I called, after confirming my identity, I was told “Chase is ending its relationship with you, your account will be closed within 10 business days, this is a final notice, there are no further comments or notes on the account.”

“Sorry, What?”

The person on the phone repeated, verbatim, the above quote, and then said that there's nothing further they can do, and ended the call.

I sat, a little flabbergasted, and thought to myself that this must be a mistake and I'll go in and check with my local branch to find out what's going on.

Chase had closed my bank accounts, with no notice, and no explanation

So on the 23rd of April I went into a Branch, sat down at one of their staff's desks and explained the situation. The lady, while very friendly, pulled up my account and repeated, verbatim, the quote from above.

I asked her to elaborate, or explain, because I felt like I was going crazy!

“My credit score just went over 800 this week, I've got all these accounts with you, nothing has happened recently that's been different, I don't transfer large amounts of money, I have run the same business for almost seven years, what's happening!?

“Chase is ending its relationship with you, your account will be closed within 10 business days, this is a final notice, there are no further comments or notes on the account.”

The repetition becomes a little crazy-inducing after the third or fourth time you hear it, but there was no pathway forward. “Back office” has closed the account, and they don't need to explain why, and their decisions are rarely, if ever reversed.

I'm not someone who yells and screams, especially at team members who are simply doing their job, so I didn't this time either. I stood up and went to the front cashier and asked to close all my accounts and get cashier checks for my accounts.

Now here's the kicker:

Chase has frozen my accounts until they can be closed

My money, in the account that they had scheduled to close, and in another that they would schedule to close a few days later, was frozen in the account.

You aren't allowed to move the money, you can't withdraw the money, and you can't have a cashier draft a cashier's check for the full amount of the account. It's stuck.

Why did Chase freeze and close my accounts?

They still won't tell me, and they likely never will.

I did the only thing that I could think of and started Googling for “Chase closed my account” and “Chase account frozen” and reading through the articles and Reddit posts until I got to this New York Times article from early 2023: Banks Are Closing Customer Accounts, With Little Explanation.

The article goes to explain that this hasn't just happened to me, and is in fact, getting more common. Accounts are closed, no real reason is given, and that's that.

Which is nuts!

I want to emphasize just how boring I am as a bank customer: I have the same incoming money each month, the same outgoings, there's really nothing exciting about me except I think I pay more tax than most of the billionaires in the country – combined.

If I'd done something weird with my accounts recently, or if I'd been making lots of international transactions, I could totally understand, but I really have no understanding what's going on. The last two transactions from my company account were tax payments to New York State and the IRS!

So why should you open multiple accounts when you move to the US?

This wild and action-filled tale has one call to action for you: Open another bank account, and put some money in it, and have it there for rainy days.

I'm very fortunate that Chase doing this didn't personally ruin my ability to live my life. I luckily have a wife with separate bank accounts, and savings in some other accounts that I could call upon and keep my life going for the time between freezing without notice, and closing (and getting my money back.)

Not everyone is that lucky though and if this does happen to you, it's very possible that you will be without cash for one or two weeks.

So the best thing I can recommend is go out to another bank, no matter who your money is with now, and start another account. Find one without fees, and keep records so you don't lose track of your money, but make sure that you've got some put away in case this happens to you. You won't need too much, and credit cards will help too in the short term, but don't get caught without your savings!

Which banks should you open accounts with?

This bit, I don't know just yet but will keep you updated where I go. Just make sure that the account you choose is FDIC-Insured, and be aware that FDIC insurance is limited per bank, not per account type, so be savvy about where your money is and how much.

Has this happened to you or do you know anything?

I'd love to hear your story! Comment below or send me an email to [email protected].

Am I following the current trend on social media to move everything to cash?

No.

I'm getting a new bank account.

We need improved regulation of banks to require valid reasoning and recourse when accounts are closed. We don't need a return to folding money.

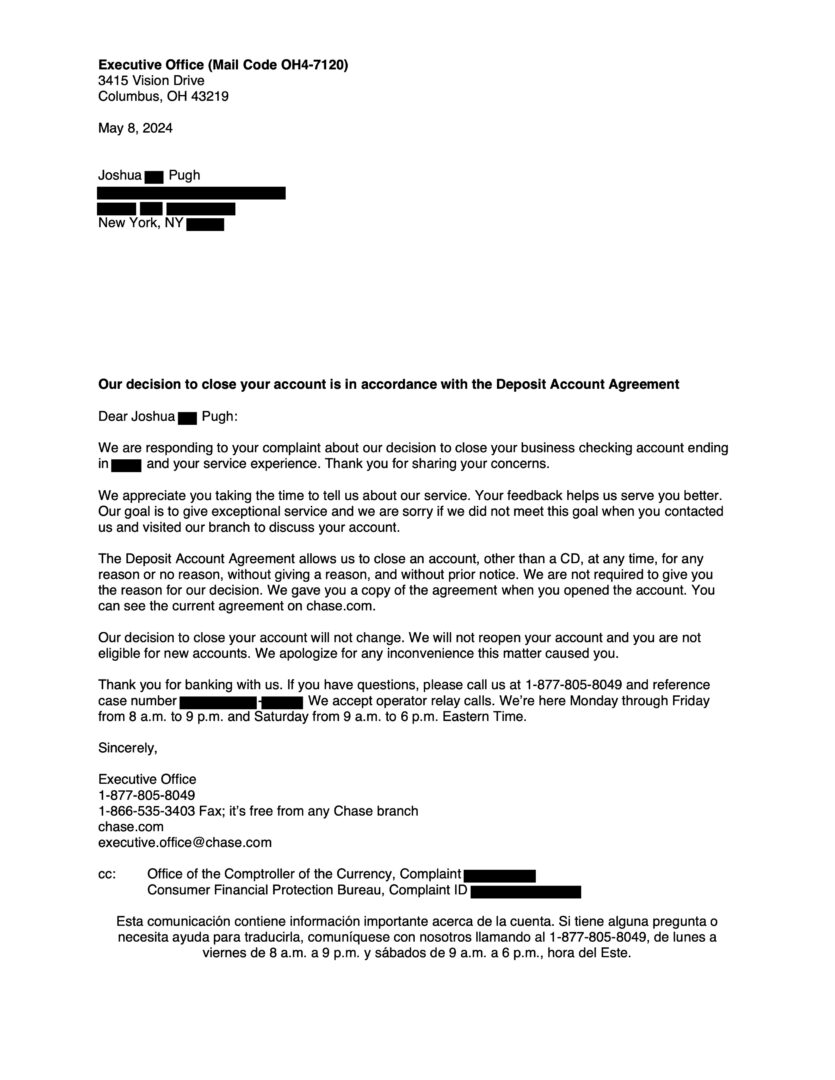

Response from Chase (May 8, 2024) after complaint

Our decision to close your account is in accordance with the Deposit Account Agreement

Dear Joshua Pugh:

We are responding to your complaint about our decision to close your business checking account ending

in XXXX and your service experience. Thank you for sharing your concerns.

We appreciate you taking the time to tell us about our service. Your feedback helps us serve you better.

Our goal is to give exceptional service and we are sorry if we did not meet this goal when you contacted

us and visited our branch to discuss your account.

The Deposit Account Agreement allows us to close an account, other than a CD, at any time, for any

reason or no reason, without giving a reason, and without prior notice. We are not required to give you

the reason for our decision. We gave you a copy of the agreement when you opened the account. You

can see the current agreement on chase.com.

Our decision to close your account will not change. We will not reopen your account and you are not

eligible for new accounts. We apologize for any inconvenience this matter caused you.

Thank you for banking with us. If you have questions, please call us at 1-877-805-8049 and reference

case number XXX-XXX. We accept operator relay calls. We’re here Monday through Friday

from 8 a.m. to 9 p.m. and Saturday from 9 a.m. to 6 p.m. Eastern Time.

Sincerely,

Executive Office

—

A quick update (5/1): The Chase branch near me was able to override the freeze and allow me to withdraw the funds from my first frozen account after lots of pleading (and it requires a Branch Manager or equivalent to do so – which are hard to find.) The second account that's so far been froze, our joint account: no such luck yet.

This sucks – I work for a bank, and unfortunately this sounds like you were flagged by the AML Anti-Money Laundering team. If you’re flagged by them for any reason, which I’m not even certain what the reason might be, they will just shut your account. I’ve also had issues with Chase freezing my account when I try to use Zelle. I agree with an earlier comment, look at a digital bank.

Yep I’ve moved by business to Bluevine and my personal to Charles Schwab!

It was good of you to share your experience with us. What a nightmare! We’ve banked with Chase for years, and my husband even longer. It’ll still take me some convincing him that this could happen to us too. A scary thought. And yes, it’s absolutely ridiculous that they are not bound to give you ANY reason for their decision. What will happen with the $ in your frozen joint account? That’s my question

So when they do close the account, they will send a check with the balance. But they’ve said that could be days or weeks before it happens!

Banks are getting too big. They don’t need the “average “ customer any longer. Bernie Sanders and Elizabeth Warren have a lot to say on this subject. Although they are not too big to fail….

Great Article Josh! Thank you for sharing your experience. I have never heard of such a thing, being canceled, frozen accounts without any good reason, but it’s a good lesson for us all to learn about being diversified with Bank accounts. We also keep liquid cash/Venmo card on hand for emergencies. Cheers.

Great to hear! Definitely came as a shock to me that’s for sure.

That’s totally scary mate! I’d be stuck up a creek without a paddle if they did this to me.(Although we do have accounts with 2 banks and two different credit cards to cover exactly these style of scenarios)

I hope you’re able to get it sorted in a timely manner

Thank you Mate!

Cash is king. Use cash you clown.

Cash is yesterday, the future is gold!

Wow that’s crazy! Thanks for sharing. I bank with Chase and have occasionally had some pretty shockingly bad experiences dealing with them, so while this surprises me, it is unfortunately believable. Definitely going to open a backup account after reading this!

So glad it can get the word out!

There are online banks like Capital One which don’t charge fees, which make it a good option for a backup.

Sensational idea

Good to know that Andrew. I’ll open one up right now as I only have one bank account. Thanks Josh for this useful article!